20 Proven Ways How to Save Money

Do you want to know how to save money? You're in luck, because we have 20 proven ways that will help you do just that! These tips are based on real-world experience and will help you cut costs without making any major sacrifices. So whether you're looking to save a little money each month or want to start saving for a rainy day, these tips will get you headed in the right direction.

1. Automate Transfers

When it comes to saving money, Automate transfers is a great way to do it. You can set up Automate transfers to automatically transfer money from your checking account to your savings account every month. This way, you don't have to think about it or remember to do it yourself. Automate transfers can also help you save for specific goals, like a down payment on a house or a new car. All you have to do is set up thetransfer and let it happen automatically. This can be a great way to stay on track with your savings goals and make sure that your money is working for you. Give Automate transfers a try and see how easy it can be to save money.

Find Out: 7 Ways to Break Out of the Credit Card Debt Cycle

2. Count Your Coins

Many people find that one of the simplest and most effective ways to save money is to count their coins and bills. By keeping track of how much money they have, they can easily avoid overspending. This method can also help people to budget their money more effectively. By knowing exactly how much they have to spend each month, they can allocate their funds more efficiently and make sure that they have enough left over for savings. In addition, counting coins and bills can also help people to spot errors on their bank statements. By regularly checking their accounts, they can catch any discrepancies and avoid being charged for mistakes that they did not make. Overall, counting coins and bills is a straightforward way to keep track of your finances and make sure that your money is working for you.

Read More: 9 Financial Tips That'll Save You Money

3. Prep For Grocery Shopping

Before heading to the store, take a moment to check your pantry and fridge to see what you already have on hand. This will help you make a more accurate list of what you need, which can prevent you from overspending on items you don't really need. It's also a good idea to create a meal plan for the week. This will help you focus your shopping trip and avoid buying ingredients that will go to waste. In general, planning ahead and being organized can help you save both time and money when grocery shopping.

4. Minimize Restaurant Spending

When trying to save money, one area that is often overlooked is restaurant spending. While it may not seem like much, those little trips to the coffee shop or grab-and-go lunch spot can really add up. If you're serious about saving money, you'll need to find ways to minimize your restaurant spending. One way to do this is to make a list of the places you normally eat out and see if there are any cheaper alternatives. For example, instead of going to the local coffee shop every day, could you make coffee at home? Or instead of buying lunch out, could you pack a lunch from home? By making small changes like this, you can quickly start to see a difference in your bank balance. Another way to save money on restaurants is to take advantage of specials and discounts. Many restaurants offer happy hour deals or early bird specials that can help you save a significant amount of money. So next time you're looking to save some money, be sure to keep restaurant spending in mind. With a little bit of effort, you can easily cut down on your restaurant expenses.

5. Get Discounts on Entertainment

If you're looking for ways to save money, you may not need to look further than your local entertainment options. Many movie theaters, museums, zoos, and other attractions offer discounts for seniors, students, military personnel, and other groups. You can also often find coupons and discounts online or in your local newspaper. By taking advantage of these discounts, you can enjoy a night out without breaking the bank. In addition, many restaurants offer specials on certain nights of the week. For example, you may be able to find deals on pizzas or burgers on Mondays or Tuesdays. By doing some research and planning ahead, you can easily find ways to save money on your next night out.

Find Out: 3 Tips to Help You Cut Costs When Writing a Will

6. Map Out Major Purchases

This allows you to set aside money each month so that you have the funds available when you need them. It also helps to avoid impulse buys that can blow your budget. Major purchases might include things like a new car, a down payment on a house, or even a trip overseas. By planning ahead, you can make sure that you have the money available when you need it without putting yourself in financial jeopardy.

7. Restrict Online Shopping

In today's world, it's easy to get caught up in the convenience of online shopping. With just a few clicks, you can have almost anything you want delivered right to your door. However, this convenience comes at a cost—literally. Online shopping can be temptation to spend money that you might not otherwise spend. By restricting your online shopping, you can save yourself both money and time. When you make the decision to shop online, take a moment to consider whether you really need the item and whether you could find it cheaper elsewhere. Chances are, if you take a little time to thoughtfully consider your purchase, you'll save yourself both money and time in the long run.

8. Delay Purchases With The 30-day rule

Everyone has experienced the urge to buy something they don't really need. Whether it's a new gadget, a piece of clothing, or even a car, we've all been tempted to make an impulsive purchase. However, these spur-of-the-moment buys can quickly add up, and before you know it, your bank balance is in the red. One way to avoid this is to practice the 30-day rule. When you're feeling the urge to buy something, wait 30 days before making the purchase. This will give you time to weigh the pros and cons of the purchase, and more often than not, you'll find that you don't really need whatever it is that you wanted. With the 30-day rule, you can save yourself both money and frustration. Give it a try next time you're feeling tempted to make an impulse buy.

9. Get Creative With Gifts

We all love to receive gifts, but sometimes the cost of buying them can be a bit of a drain on our finances. If you're looking for ways to save money, one option is to get creative with your gifts. Instead of buying something new, try making something yourself or finding a second-hand item that has special meaning. If you're not crafty, you could also try giving an experience rather than a physical object. A voucher for a day at the spa or tickets to a show are always appreciated and won't break the bank. Whatever route you choose, taking the time to put thought into your gifts will show your loved ones how much you care - without breaking the bank.

10. Lower Your Car Costs

There are a number of ways to save money on your car costs. One way is to lower your monthly payments by refinancing your car loan. Another way is to sell your car and buy a less expensive one. You can also save money by buying a used car instead of a new one. Finally, you can reduce your car costs by taking public transportation or riding a bike instead of driving. By taking some or all of these steps, you can easily save hundreds or even thousands of dollars on your car costs.

11. Bundle Cable and Internet

Bundling cable and internet services is a great way to save money. By combining both services into one bill, you can often get a discount on your monthly rate. In addition, bundling can also make it easier to keep track of your expenses. Instead of having two separate bills to pay each month, you can just have one. And if you have any questions or problems with your service, you only have to deal with one company instead of two. So if you're looking for ways to save money on your monthly expenses, bundling cable and internet is a great option.

12. Switch Your Cell Phone Plan

Cutting back on expenses is a great way to save money, and one area where you can often trim your spending is your cell phone bill. There are a number of ways to do this, but one of the most effective is to switch your cell phone plan. Many people are paying for features that they don't even use, or they are locked into a plan that no longer meets their needs. By shopping around and taking the time to find the right plan, you can often save a significant amount of money each month. So if you're looking to cut back on your spending, switching your cell phone plan is a great place to start.

13. Reduce Your Electric Bill

Conserving electricity is not only good for the environment, it's also good for your wallet. There are a number of easy ways to reduce your electric bill each month, and by making a few simple changes you can see a significant difference in your bottom line. One of the easiest ways to reduce your electricity usage is to simply turn off lights when you leave a room. You can also save electricity by using energy-efficient light bulbs, which use less power than traditional incandescent bulbs. During the warmer months, fans can be used to circulate air instead of air conditioners, and in the winter, wearing warmer clothing or using a space heater can help reduce your heating bill. By making a few small changes, you can save money on your electric bill each month.

14. Lower Your Student Loan

By refinancing your loans at a lower interest rate, you can immediately start saving money on your monthly payments. In addition, you can also extend the term of your loan, which will further reduce your monthly payments. If you have private loans, you may also be able to consolidate your loans into a single loan with a lower interest rate. By taking these steps, you can quickly start saving money on your student loan payments.

15. Cancel Unnecessary Subscriptions

One simple way to start saving money is to cancel any unnecessary subscriptions. This could include things likegym memberships, magazine subscriptions, or even streaming services that you no longer use. By getting rid of these monthly expenses, you can free up a significant amount of money each month. Another option is to downsizeto a cheaper cable or cellphone plan. There are many ways to save money on your monthly expenses, and cancelling unnecessary subscriptions is a great place to start. So take a look at your budget and see where you can start cutting back.

16. Refinance Your Mortgage

Homeowners who are struggling to keep up with their mortgage payments may want to consider refinancing their loan. Although the process can be complex and time-consuming, it could ultimately save you thousands of dollars over the life of your loan. When you refinance, you essentially take out a new loan with terms that better fit your current financial situation. This could mean a lower interest rate, a shorter repayment period, or both. If you're able to secure a lower interest rate, you'll save money on your monthly payments. And if you're able to shorten your repayment period, you'll pay less in interest over the life of the loan. Either way, refinancing can be a great way to save money on your mortgage.

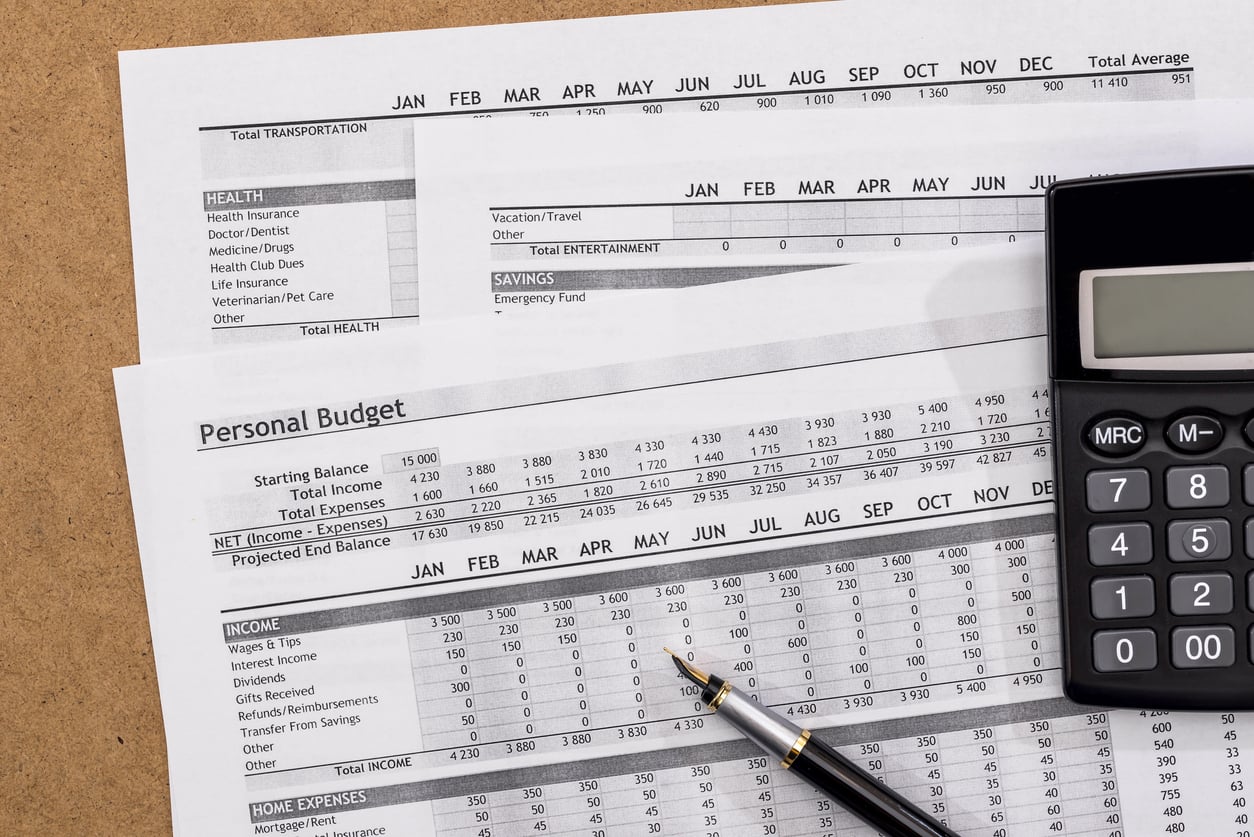

17. Set Saving Goals

It's never too early to start saving money. If you're looking to make your money stretch further, setting savings goals is a great place to start. Not only will it help you stay on track with your finances, but you'll also be less likely to splurge on unnecessary purchases. When it comes to setting savings goals, the sky's the limit. Whether you're looking to save for a down payment on a house or simply want to boost your emergency fund, there's no wrong way to save. The key is to come up with a plan that works for you and your budget. Once you have a goal in mind, set up a budget and start setting aside money each month.

18. Track Spending

By taking note of all the money you spend in a month, you can start to see where your money is going and where you can cut back. For example, if you find that you are eating out a lot, you may want to start cooking more meals at home. Or, if you discover that you are spending a lot on clothes, you may want to start shopping at thrift stores or Second Hand rose. Tracking your spending can also help you identify any unnecessary expenses that you can eliminate

19. Pay Off High-Interest Debt

Debt can be a financial millstone around your neck, rapidly draining your hard-earned cash in the form of high interest payments. If you're struggling to make ends meet, it may be tempting to simply minimum payments each month and hope for the best. However, this is often a recipe for disaster. Interest rates on credit cards and other forms of debt can quickly spiral out of control, leaving you trapped in a cycle of debt. One of the best ways to break free from this cycle is to pay off your high-interest debt as quickly as possible. By doing so, you'll save money on interest payments and will be able to focus on more productive uses for your money. While it may require some sacrifice in the short-term, paying off high-interest debt is one of the smartest financial decisions you can make.

20. Keep Savings In a High-Yield Savings Account

These accounts tend to offer higher interest rates than other types of accounts, which means that your money will grow more quickly. In addition, many high-yield savings accounts offer additional benefits such as online banking and mobile check deposit. As a result, you can easily access your money when you need it. Plus, you'll earn more interest on your savings over time. So if you're looking for a great way to save money, be sure to consider keeping your savings in a high-yield savings account.

More from Cheapgenius: