2026 Social Security COLA: How Much Extra Cash You’ll See in Your January Check

Did you just hear that Social Security checks are going up in January 2026 and wonder what it means for you? This is when many retirees start doing the math. You may want to know how much extra cash will land in your account and whether it will really help with rising prices.

How big is the 2026 COLA? When will you see the increase in your check? Will Medicare or taxes eat part of that raise? Read on and let’s walk through the answers in simple, clear steps.

What Is The 2026 COLA?

The 2026 Social Security cost of living adjustment, or COLA, is set at 2.8 percent. This increase applies to both Social Security and Supplemental Security Income (SSI) benefits.

Nearly 71 million people getting Social Security will see this 2.8 percent bump starting with payments paid in January 2026. Around 7.5 million SSI recipients get their higher payments a little earlier, with the boosted amount arriving on December 31, 2025.

How COLA Affects Your January Check

The increase for 2026 is based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers, known as the CPI W. The government compares the average CPI W for July, August, and September of 2025 with the same months in 2024, and that percentage change becomes the COLA.

Because of this, your January 2026 benefit will be about 2.8 percent higher than your December 2025 Social Security payment. The raise is automatic, so you do not need to file a new application or request the increase.

Average Raises in Dollars

It is easier to understand the 2.8 percent COLA when you see it in dollar terms. The Social Security Administration provides examples based on average benefits.

- The average retired worker will see a monthly benefit go from 2,015 dollars to 2,071 dollars, a gain of about 56 dollars.

- An aged couple who both receive benefits will see an average increase from 3,120 dollars to 3,208 dollars, or about 88 dollars more per month.

For disabled workers, the average monthly benefit rises from 1,586 dollars to about 1,630 dollars, adding roughly 44 dollars each month. Widows and families receiving survivor or disability benefits see similar percentage increases based on their own amounts.

Quick Benefit Examples

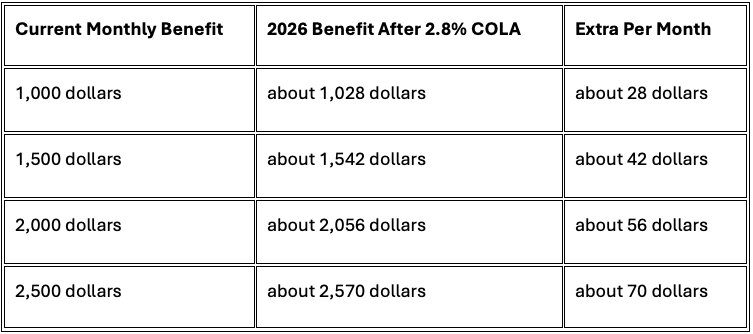

Here are simple examples of how a 2.8 percent COLA changes common benefit levels. These are rounded numbers for illustration.

These examples show the raise is modest but steady. Over a full year, even an extra 40 to 70 dollars each month can help cover food, gas, or co‑pays.

When You’ll See The Money

The higher Social Security payments start with benefits paid in January 2026. Your exact pay date still follows the usual payment schedule, which depends on your birthday or whether you receive certain types of benefits.

If you receive SSI only, your first COLA boosted payment arrives on December 31, 2025. People who receive both Social Security and SSI see the SSI increase on that date, and then the Social Security increase with the January 2026 payment.

How COLA Is Calculated

Under current law, COLA is tied directly to inflation, not to politics or a special vote in Congress each year. The CPI W measures price changes for a basket of goods and services, including food, energy, and medical costs.

The government compares the third quarter average of one year with the third quarter average of the prior year to get the COLA percentage. If prices go up, benefits go up; if there is no increase in the CPI W, there is no COLA for the next year.

How This COLA Compares To Recent Years

The 2.8 percent COLA for 2026 is slightly higher than the 2.5 percent increase given in 2025. However, it is lower than the unusually large increases that followed the sharp inflation spike in 2022 and 2023.

Over the last decade, the average COLA has been a bit above 3 percent, so the 2026 adjustment is close to that longer term pattern. Many advocacy groups still argue that even these increases can lag behind the real cost of living for older adults, especially when it comes to housing and health care.

What Could Shrink Your Raise

The COLA boosts your gross benefit, but the amount you actually see in your bank account can be lower after deductions. Higher Medicare Part B premiums can eat into part of the increase for many retirees.

If your total income goes up enough, more of your Social Security might also be subject to income tax, especially if you have other retirement income. This means the 2.8 percent raise on paper may feel smaller once Medicare and taxes come out.

What You Should Do Now

There are a few simple steps you can take before the January payment arrives. First, log in to your online “my Social Security” account to view your COLA notice and confirm your updated benefit amount.

Next, look at your budget. Adjust your plan for 2026 with the higher monthly income in mind, but remember that some of the raise may go toward Medicare or higher prices. If anything in your notice looks wrong, contact Social Security as soon as possible to clear it up.

Key Takeaway For Your January Check

The 2026 Social Security COLA is 2.8 percent, and you will see it reflected in the payment you receive in January. For the average retired worker, that means about 56 dollars more each month, with larger or smaller increases for others depending on their current benefits.

The increase is automatic, but its impact depends on your full financial picture, including Medicare and taxes. By checking your notice, updating your budget, and planning ahead, you can make the most of the extra cash that comes with your 2026 Social Security COLA.