Claim Your Social Security Check Boost Before the New 2026 Rules Kick In

Claiming certain Social Security strategies before 2026 can lock in a higher lifetime check. This is important especially if you plan carefully around the new cost-of-living adjustment and earnings rules coming next year. The goal is to combine smart timing with simple steps, so you do not leave easy money on the table.

Why 2026 Matters

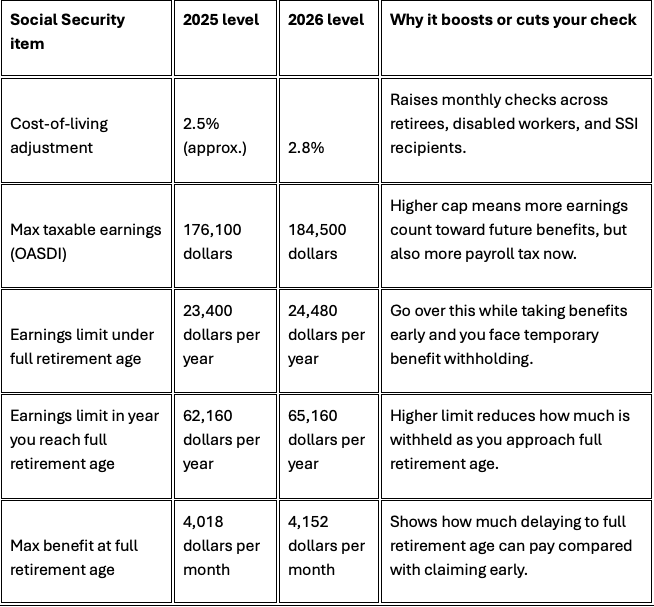

In 2026, Social Security checks will get a 2.8% cost-of-living adjustment, which will raise the average monthly retirement benefit by about 56 dollars. That is good news, but it also means the program continues to tighten earnings tests and taxable wage limits that can shrink what actually lands in your bank account if you are not prepared.

The maximum earnings subject to Social Security tax will rise to 184,500 dollars in 2026, up from 176,100 dollars. For high earners, this shift can change how much you contribute now and how much benefit you eventually receive, so planning in 2025 is crucial.

The New 2026 Rules in Plain English

From 2026, the annual earnings limit for people taking benefits before full retirement age climbs to 24,480 dollars a year, or 2,040 dollars a month. If you earn more than that from work, Social Security withholds 1 dollar in benefits for every 2 dollars over the limit.

For the year you reach full retirement age, the earnings limit jumps to 65,160 dollars and the reduction formula becomes 1 dollar withheld for every 3 dollars over that higher limit. Once you hit full retirement age, the earnings limit disappears and you can work and earn any amount without having your Social Security check reduced.

What “Check Boost” Really Means

A “Social Security check boost” is not one single trick. It is a mix of timing and income decisions that lift your actual monthly payment. The 2.8% cost-of-living increase in 2026 is automatic, but the real boost comes from how you position yourself before those rules kick in.

If you claim early and keep working without watching the earnings limits, you can see part of that COLA-driven increase offset by withheld benefits and higher Medicare premiums. If you plan ahead, you can avoid or reduce those hits and protect the full boost the new COLA is supposed to give you.

Simple Moves to Make In 2025

Here are clear steps you can start taking now so you enter 2026 on stronger footing.

- Check your full retirement age and current estimate

Log in to your online Social Security account to see your projected benefit at different ages. This allows you to see how much more you get by waiting a year or two versus claiming right away. - Map your 2025 and 2026 work income

If you will claim benefits before full retirement age, add up what you expect to earn from work in late 2025 and all of 2026. Try to keep your wages under the 2026 earnings limit or at least know exactly how much of your benefit could be withheld so it does not surprise you. - Time your claim around the earnings test

If 2026 will be a high-earning year, consider delaying your claim until you reach full retirement age, so the earnings limit no longer applies. If your income will drop in 2026, it might make sense to delay claiming until after that drop so less of your check is reduced by the test.

How To Lock in a Higher Starting Check

Your starting benefit is the base that every future COLA will sit on. That is why timing matters more than most people think. If you claim at full retirement age instead of early, or delay past full retirement age, each yearly COLA in 2026 and beyond compounds on a larger base amount.

Delaying up to age 70 can earn delayed retirement credits, which increase your monthly benefit for life. Because the 2026 COLA is already set, decisions you make in 2025 change how big that inflation bump looks in your actual dollar terms for years to come.

Key Numbers to Watch

Here is a quick snapshot of the most important 2026 numbers you should keep in mind as you plan.

Coordinating With Medicare and Taxes

Many retirees forget that Medicare premiums often come out of their Social Security checks. In 2026, some people with higher incomes will see larger Medicare Part B premiums due to income-related adjustments, which can eat into the COLA increase. There is a “hold harmless” rule that prevents the standard premium hike from completely wiping out COLA for many beneficiaries, but not for everyone.

Because of that, decisions about part-time work, withdrawals from retirement accounts, and when to start Social Security, all interact with your tax bracket and Medicare costs. Before 2026 begins, it helps to run projections or speak with a financial professional, so you do not accidentally trade a small boost now for a larger hidden cost later.

Putting It All Together Before 2026

To claim your Social Security check boost before the 2026 rules take full effect, keep your plan simple and focused. Know your full retirement age, decide when to claim, keep an eye on the earnings limits, and think about how work income and Medicare premiums will affect what you actually take home.